Can You Still Be Fined for Not Having Health Insurance

What Is The Time Frame To Enroll

How to Get Medical Care if You Have No Money and No Insurance

The open enrollment period for Obamacare plans is the time of the year when most people tin can sign up for a market place health insurance plan. These dates change every year, just tend to fall in the autumn for coverage starting in Jan. If you miss the open up enrollment period you'll have to wait another twelvemonth to sign upwards, unless you qualify for a special enrollment menstruum through a life issue like losing a chore, having a child, or getting married.

Almost people tin can enroll at Healthcare.gov. But residents of 18 states volition need to sign up through their state's website. If you miss the deadline to enroll, you may face state fines if your state imposes them, so exist sure to stay on top of your enrollment.

If y'all truly cannot beget health coverage, you may desire to come across if you qualify for Medicaid. Yous tin can use for Medicaid at any fourth dimension of year.

You tin can too enroll in independent health insurance throughout the yr. An insurance agent tin help you choose the all-time plan for you.

Is There A Penalty For Non Having Health Insurance

Likewise often, people acquire that the personal penalty for non having health insurance is the exorbitant healthcare bills. If you fall and interruption your leg, hospital and doctor bills can chop-chop reach $seven,500for more than complicated breaks that require surgery, you could owe tens of thousands of dollars. A three-mean solar day stay in the hospital might toll $30,000. More than serious illnesses, such as cancer, tin can cost hundreds of thousands of dollars. Without health insurance, you are financially responsible for these bills. Two-thirds of people who file for defalcation signal that medical bills contributed to their financial situation, according to a 2022 study.

The Affordable Intendance Act increased the number of people with insurance and lowered those who couldnt beget to pay their wellness bills. While the federal health insurance coverage mandate and shared responsibility payment was in outcome, from 2022 through 2018, the number of people in the United states who got health insurance increased by around xx meg.

Since 2019, at that place is no federal penalization for not having health insurance, says Brad Cummins, the founder and CEO of Insurance Geek. Withal, sure states and jurisdictions accept enacted their wellness insurance mandates. United states of america with mandates and penalties in consequence are:

- California

- Preventive and wellness services

- Pediatric services

In that location are a multifariousness of health plans that meet these requirements, including catastrophic and high deductible plans.

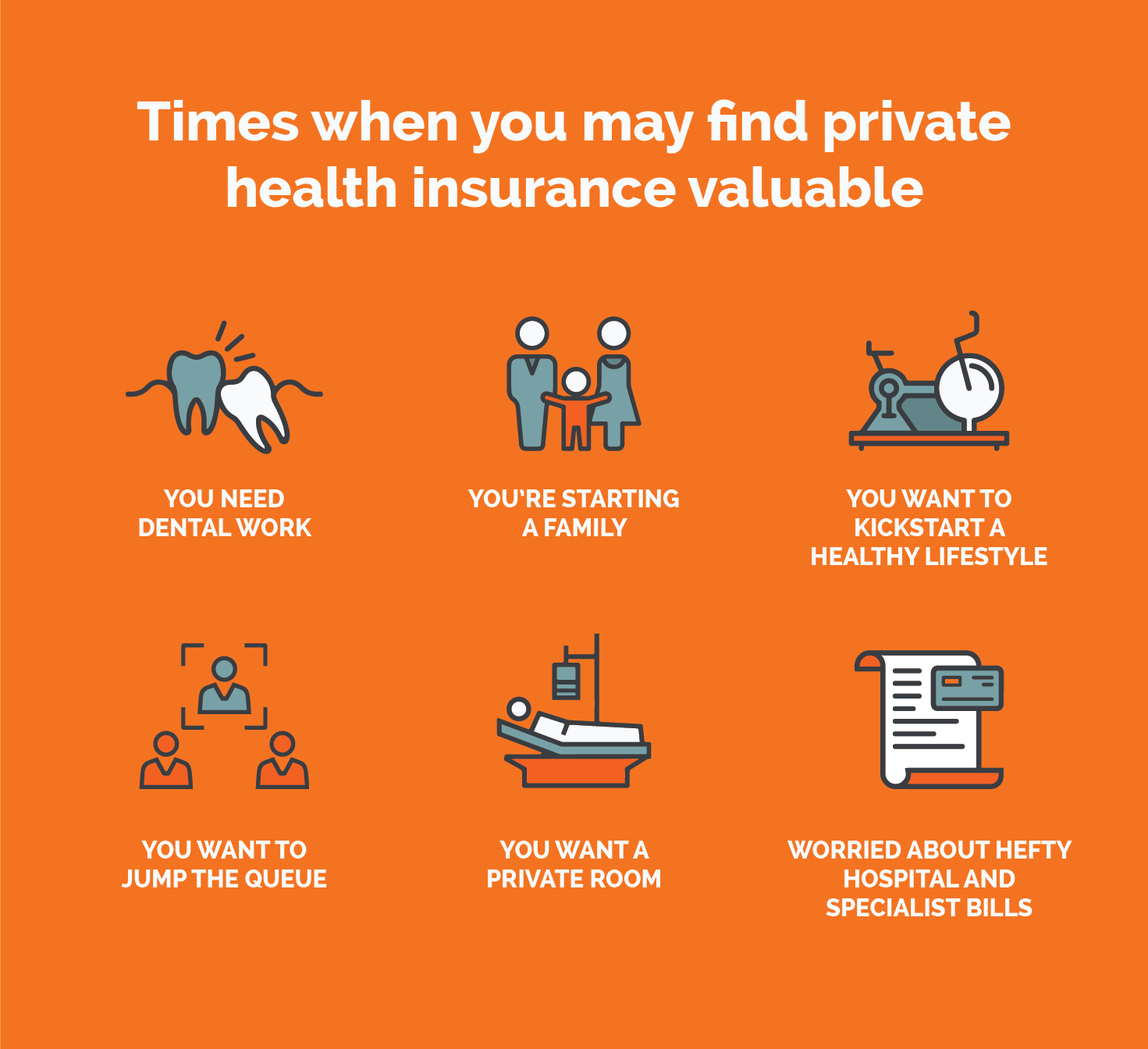

Reasons To Get Health Insurance

While yous may not want to spend the money on wellness insurance, in that location are of import reasons that it should be a high priority. Dealing with an unexpected medical emergency like appendicitis or a broken leg from an accident can be very expensive. Co-ordinate to HealthCare.gov, casting a broken leg tin cost $7,500. If yous demand to stay in the hospital for iii days, look a bill for effectually $30,000.

Medical debt tin bankrupt y'all. If yous are in a car wreck and break both legs, you'll exist in the hospital for a few days. A bill of $15,000 for the broken legs and $thirty,000 for the three-day stay could of a sudden put you in $45,000 of debt. Many hospitals volition work with you to set a payment plan, but the minimum payments may still be more than y'all tin afford and information technology may take you decades to pay off the debt.

Health insurance makes information technology easier to become preventive care, too, then that yous do non need more expensive procedures afterwards. Taking care of small things similar ear or sinus infections tin can prevent yous from developing more serious complications.

Many plans assistance cover the cost of annual physicals. Annual physicals can identify unknown medical issues, possibly preventing yous from collecting unexpected medical bills.

Recommended Reading: Can Substitute Teachers Get Health Insurance

Was Wellness Insurance Mandatory For The Entire Twelvemonth

For all years after the ACA went into event until Jan. one, 2019, health insurance was mandatory for the entire year. Youll only pay a penalization, though, for any months of the yr before 2022 that you were uninsured. So, if you did accept coverage for some of the year, the penalty fee will only apply to the non-covered months. Technically, you dont accept to have health insurance all 365 days a year to avoid the tax penalisation. If you have coverage for even only 1 day of a month, the IRS considers this as having minimum essential coverage for the entire month.

In addition, you could also authorize for a curt coverage gap exemption. You will qualify for this exemption if your lack of health insurance coverage was for a menstruum of less than three months. However, this coverage merely applies to the first gap each year, so if you lack health insurance more one time during a calendar year, the exemption volition only comprehend the first gap. For example, if you do non accept insurance in May and then over again in September, you will only exist exempt for May and have to pay the penalization for your second gap.

How To Utilize For An Exemption For 2022 And Before

Depending on the type of exemption yous qualify for, yous volition demand to submit an application to Healthcare.gov or request the exemption from the Internal Revenue Service when you file your taxes. .

- Federal Wellness Insurance Market place : Go to HealthCare.gov to determine which exemption to request. Impress out, complete and mail the federal Application for Exemption. The completed form and whatsoever supporting documents should be mailed to:Wellness Insurance Market place – Exemption Processing465 Industrial Blvd.London, KY 40741

- IRS: Information for challenge an exemption through the IRS when yous file your taxes can exist found at www.irs.gov.

MNsure uses the federal Health Insurance Market to process exemption applications. The federal government will notify you if yous authorize for an exemption. If y'all employ to HealthCare.gov and qualify, you lot volition receive an exemption certificate number that you'll need for your federal income tax return you file for the twelvemonth of the exemption. For questions about the status of your awarding or your eligibility for an exemption, visit HealthCare.gov, or call the Wellness Insurance Market Help Center at 800-318-2596. TTY users should call 855-889-4325. If y'all have questions well-nigh how to get a copy of and where to submit the application course, telephone call the MNsure Contact Center at 855-366-7873 or 651-539-2099.

Don't Miss: Is Family Health Insurance Cheaper Than Individual

What Are My Options For Complying With Obamacare

You take three options and ii of them involve a punishment:

- Go no insurance and pay a penalty for no health insurance at tax time.

- Get cheap insurance and pay a penalty at taxation time.

- Enroll in a qualified health plan. This option does not have to be through Covered California to avoid the penalty, merely it does have to be a Covered California plan in order to qualify for a regime subsidy.

- Enroll in a Health Care Sharing Plan, which is exempt from the penalty and my offering lower premiums than traditional health insurance.

Tin can I Go The Hospital If I Practise Non Have Health Insurance

Hospitals in the Us of America are required to provide service to anyone in the case of an emergency and so you tin go to any hospital. All the same, you may be responsible for roofing the unabridged cost of this visit which tin can be expensive.

It is of import to not put off an emergency visit due to the expense considering you are putting your health at take a chance.

If you lot meet the income requirements, some hospitals might enroll you in Medicaid when you lot are there for your medical visit. Medicaid will then help comprehend the costs of the services at the infirmary.

Medicaid will as well pay for treatment of a serious medical emergency for those who meet Medicaid requirements simply do not accept the required immigration status to enroll in Medicaid.

States that did not expand their Medicaid plan under the Affordable Intendance Act may accept dissimilar requirements for enrollment than states that did. This information could be subject to change if the Affordable Care Act is repealed.

Enter your zip code above to get free health insurance quotes and explore your options!

Read Also: What Causes Health Insurance Premiums To Increment

What Type Of Programme Is Best For Basic Protections

High Deductible Health Plans with Health Savings Accounts are an excellent option for coverage to protect yous in a catastrophic upshot but has low monthly premiums.

Every bit of 2021, individuals are simply eligible for HSAs if they have a $one,400 deductible, but can save up to $3,600 a year for health care services if they cull to enroll in an HDHP. Families are eligible for an HSA if they have a $2,800 deductible and can salvage up to $7,200 a year.

At that place are many advantages to an HDHP with an HSA which include:

- Low monthly premiums.

- Financial protections that limit your health care spend exposure.

- Funds in HSAs collect interest.

- HSA funds whorl over year to year.

- Funds are saved for hereafter medical costs and retirement wellness costs.

- HSA contributions are tax-deductible.

Aca Goal: Insure About Americans And Keep Them Insured

I'm 60 and Single with $750K Can I Retire With $60K per Year and What about Taxes

The overarching goal of the Affordable Care Deed was to extend health insurance coverage to as many Americans as possible. In that regard, it's had significant success. From 2010 through 2016, the number of people with health insurance in the U.South. increased past roughly 20 meg. And although the uninsured rate has been increasing since 2017, it has been beneath 10% since 2015.

But while access to health insurance is important, it'south also important that people maintain their coverage going forward. Keeping as many people as possible in the take a chance poolespecially when they're salubrious and not in need of firsthand carekeeps premiums affordable. And while health insurance coverage is certainly non cheap, it would be far more expensive if people could just wait to purchase coverage until they were in need of medical intendance.

Don't Miss: How Much Subsidy For Health Insurance

Rhode Isle Individual Mandate

- Constructive date: January 1, 2020

- Requires individuals and their dependents have ACA-compliant health insurance

- Imposes a penalisation on residents who become without wellness insurance merely can afford it

- Provides country subsidies to assist lower income residents afford wellness insurance

The penalisation for failure to have ACA-compliant health insurance is the same every bit it would have been under the federal individual mandate. It will price a family $695 for each uninsured developed and $347.fifty for each uninsured kid or two.5% of the household income, whichever corporeality is greater. Penalties also increment annually with inflation. However, the maximum a household can be penalized cant be greater than the total annual premium for an average bronze plan in Rhode Island.

Rhode Island allows for exemptions in certain situations. And, as of December 31, 2020, Rhode Island expanded its eligibility criteria to include a COVID hardship exemption. This new exemption recognized the impact that the pandemic may have had on residents power to beget and get wellness insurance. If you alive in Rhode Island, you may be eligible to file a hardship exemption if, as a outcome of the COVID pandemic:

- You lost minimum essential coverage in 2020, or

- You experienced a hardship that made you lot unable to get minimum essential coverage in 2020.

How The Penalty Worked

Your individual mandate tax is the greater of either 1) a flat-dollar amount based on the number of uninsured people in your household or two) a pct of your income .

This means wealthier households volition current of air up using the 2nd formula, and may exist impacted by the upper cap on the penalization. For case: for 2017, an private earning less than $37,000 would pay only $695 while an individual earning $200,000 would pay a penalty equal to the national boilerplate cost of a bronze plan . This is considering 2.5% of his income above the tax filing threshold would work out to nearly $four,740, which is higher than the national average cost of a bronze plan. The IRS publishes the national average cost of a bronze plan in August each year that amount is used to calculate penalty amounts when returns are filed the following year.

You May Similar: Can You Purchase Health Insurance Any Time Of The Year

Who Does The Private Mandate Use To And Who Is Exempt

Nigh all U.Southward. citizens who did not have health insurance between 2010 and 2022 may yet owe a penalty fee next year or in the future based on the individual mandate. This fee comes in the class of an actress tax you must pay for the time you didnt have coverage. People who qualify for a health coverage exemption for past years includes anyone who:

- Was incarcerated.

- Had an income that was then low that filing a tax return was not a requirement.

- Were members of a Native American tribe.

- Had a religion that objects to having health insurance.

- Belonged to a healthcare sharing ministry.

- Was in the U.S. illegally.

- Qualified for a hardship exemption.

- Paid more than a certain percentage of their income to their health insurance. The IRS set up the exact percentage each twelvemonth.

Yous can likewise visit HealthCare.gov to learn more about exemptions from the individual mandate and how to employ for an exemption if yous qualify.

Starting in 2019, though, you do not have to pay any kind of punishment fee or tax if yous do non have coverage, regardless of whether or not you qualify for an individual mandate exemption. However, there are a few states that still enforce the individual mandate which well talk about below.

Why Practice I Demand Insurance If Theres No Penalisation

The cost of self-pay and out-of-pocket expenses for healthcare are highyear after yr, the cost of routine care increases. Things like Emergency Room visits and hospital admissions stand to put a heavy financial burden on families without substantial savings for crises.

With over half of American defalcation filings being associated with medical debt, having health insurance tin can provide many fiscal protections. Without insurance, unforeseen health problems can expose you to crippling costs.

Recommended Reading: How To Become A Health Insurance Broker In California

How To Avoid Paying A Penalty For No Health Insurance

The easiest way to avoid paying a penalisation for not having health insurance is to enroll in an accepted and credible health plan for your land. The Affordable Care Act, sometimes chosen Obamacare, specifies anopen enrollment period when people can enroll in plans offered through the federal or state health insurance marketplaces. An open enrollment menses is a gear up time when people can sign upwards for or change their plans. When yous sign up for health insurance during the open enrollment, the insurer must provide y'all insurance. If you do not sign up during this fourth dimension, you cannot sign up until the side by side open enrollment unless you experience certain life events.

In 2021, due to COVID, there was a Special Enrollment Period between Feb. 15 and Jun. xxx, according to Cummins. During this time, over 1.5 1000000 Americans signed up for new insurance coverage through healthcare.gov. For 2022, open enrollment begins on Nov. 1, 2021, and ends on Dec. 15, 2021.

Besides plans on the Marketplace, yous can during three main periods in the yearthough, in some states, similar New York, you can enroll in a supplemental plan year-round:

- Initial enrollment menses

- Open enrollment period

- Special enrollment menstruation

Some people can enroll in health insurance plans offered on the state and federal exchanges during times other than thespecial enrollment menstruum , if they experiencecertain life events, such equally:

Option #3 Shop Around

Perhaps yous dont have insurance solely because y'all think information technology is too expensive. Peradventure it is simply a state of listen. There are many quality, affordable plans bachelor today. Shopping around is a cracking way to compare dissimilar companies. Premium rates will vary based on age, health history, medical conditions, and life way choices. Seeing dissimilar options side past side tin can assist you see what choices are bachelor.

You tin use the comparison tool on this page correct at present. The tool will prove you rates and quotes from top companies so you can compare. If you have additional questions after you lot use the comparison tool, y'all tin can contact one of our independent agents who tin can help y'all. By shopping around you can rest assured that you found the right coverage for the right toll.

Read Likewise: How Much Do Health Insurance Agents Make

No More Tax Penalties

In 2018, the ACA revenue enhancement punishment was $695 for adults and $347.fifty for children, or 2% of one'due south annual income, whichever amount was more. However, on December 22, 2017, when President Trump signed the Tax Cuts and Jobs Human activity, it repealed the ACA-related taxation on Americans who refuse to buy health insurance.

As of 2019, Americans without health insurance are not taxed by the government. Even so, individuals and families who choose to become without wellness insurance do so at their own take chances.

If My Plan Is Not Aca

Do You Need Dental Insurance?

All ACA-compliant plans in the individual and small group markets are required to cover the ACAs essential health benefits without whatsoever caps on the total corporeality that the programme spends on your intendance. Then theyll provide a solid safety internet if you end upwards needing significant medical care . And all ACA-compliant plans are required to cover pre-existing conditions without any waiting periods.

But if y'all buy a plan thats not ACA-compliant, the insurer will be probable to use medical underwriting to conform the premiums or the coverage based on your medical history, and the program wont have to comprehend the essential health benefits unless the state has its own requirements .

Don't Miss: How Do You Pay For Health Insurance

Source: https://www.healthinsurancedigest.com/can-i-be-fined-for-not-having-health-insurance/

0 Response to "Can You Still Be Fined for Not Having Health Insurance"

Post a Comment